Our teams support Producers and creatives to bring their visions to life, creating unforgettable performance for audiences, presented in our landmark venues and delivered with exceptional hospitality

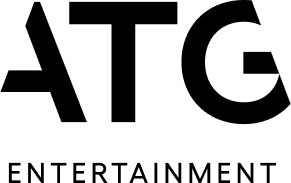

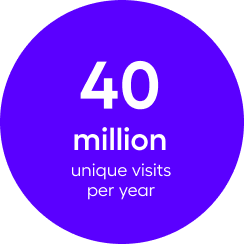

We lead the world in theatre ticketing

18 million people a year get their tickets to hit musicals, plays, concerts, comedy shows, attractions and exhibitions from us. With platforms including atgtickets.com, LOVEtheatre.com and Group Line, we run Britain’s most popular theatre ticketing sites.

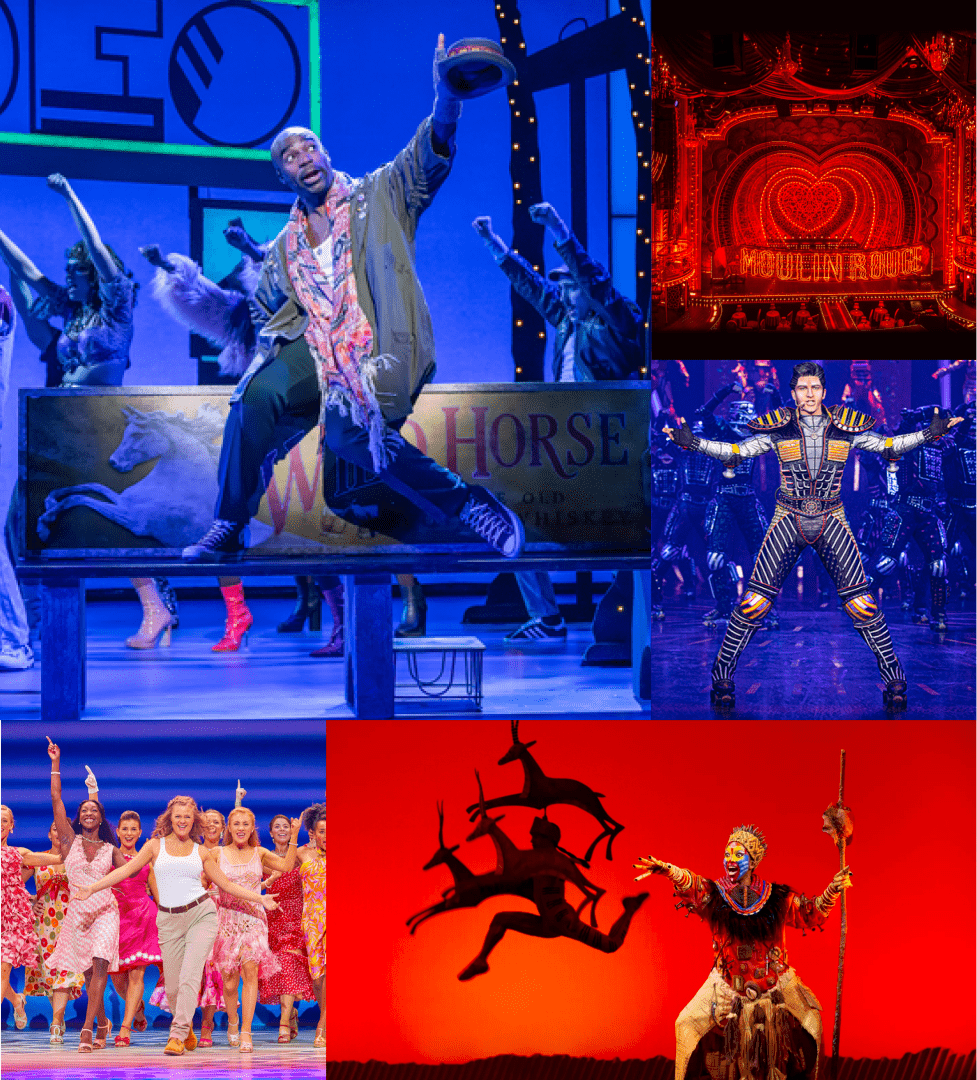

We present the world’s best live entertainment

By partnering with the worlds leading producers and creative artists, our venues present an extraordinarily diverse range of top-quality entertainment.

We’ve built a team of experts.

Live entertainment isn’t just about what happens under the spotlights. With diverse backgrounds and skills, our people deliver best-in-class experiences across everything we do – from ticketing to marketing and hospitality.